BA Launches Avios Prepaid Mastercard

BA has recently launched an Avios Prepaid Mastercard allowing you to collect Avios on your spending. Whilst the earn rate isn’t particularly high it may be a useful option for those who don’t have a card with no foreign exchange fees or prefer not to hold a credit card…

The BA Avios Prepaid Mastercard

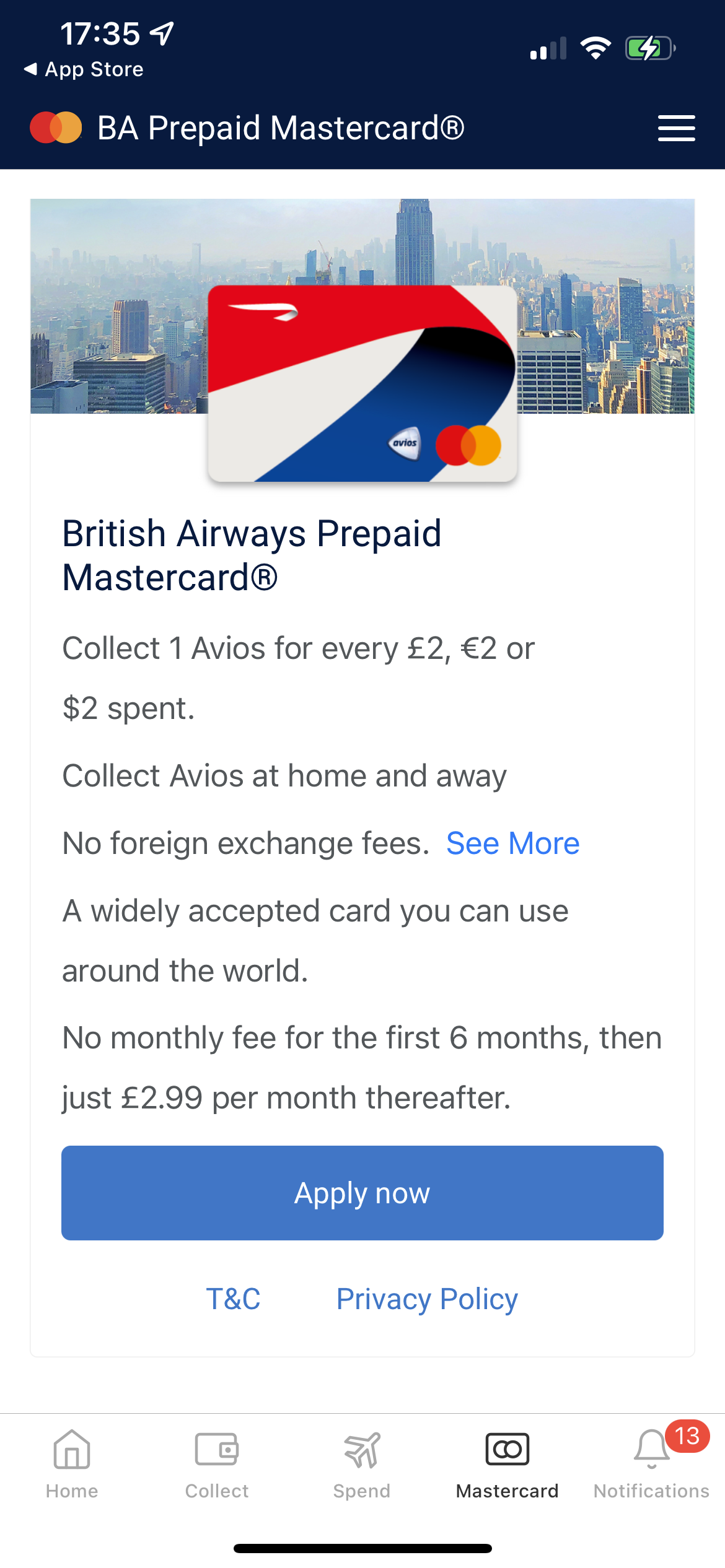

The card offers the following features… (Don’t forget as this is a prepaid card you will need to top up before using the card using your debit card in the Executive Club app.)

- Collect 1,500 bonus Avios when you spend £500, €500, or $500 in your first 90 days.

- No monthly fee for the first 6 months, then just £2.99 per month thereafter.

- 1 Avios per £2 on eligible purchases (Avios are calculated on the amount of the Transaction and then rounded to the nearest full Avios e.g. an £11.99 purchase would earn 6 Avios rather than 5)

- No FX Fees when using your currency e-wallet.

You can read more details about the card here – https://www.britishairways.com/en-gb/executive-club/collecting-avios/shopping/mastercard

How do I apply for the BA Avios Prepaid Mastercard?

To apply you need to meet the following requirements…

- be over 18 years of age

- be a UK resident

- be a member of the British Airways Executive Club. Join here.

- hold a valid debit card, which is registered against a UK bank account.

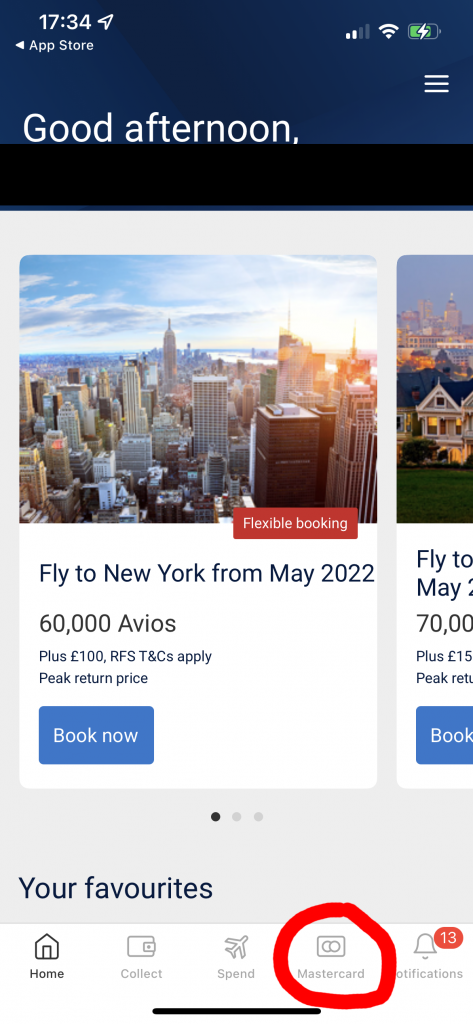

Unlike most cards, you can’t just apply online in your web browser you need to apply through the Executive Club iOS/Android App. Ignore the fact the BA website says you can’t currently apply through the iOS app, you can. Once you have the app & logged in to your BA account you will be able to select the Mastercard option at the bottom to apply.

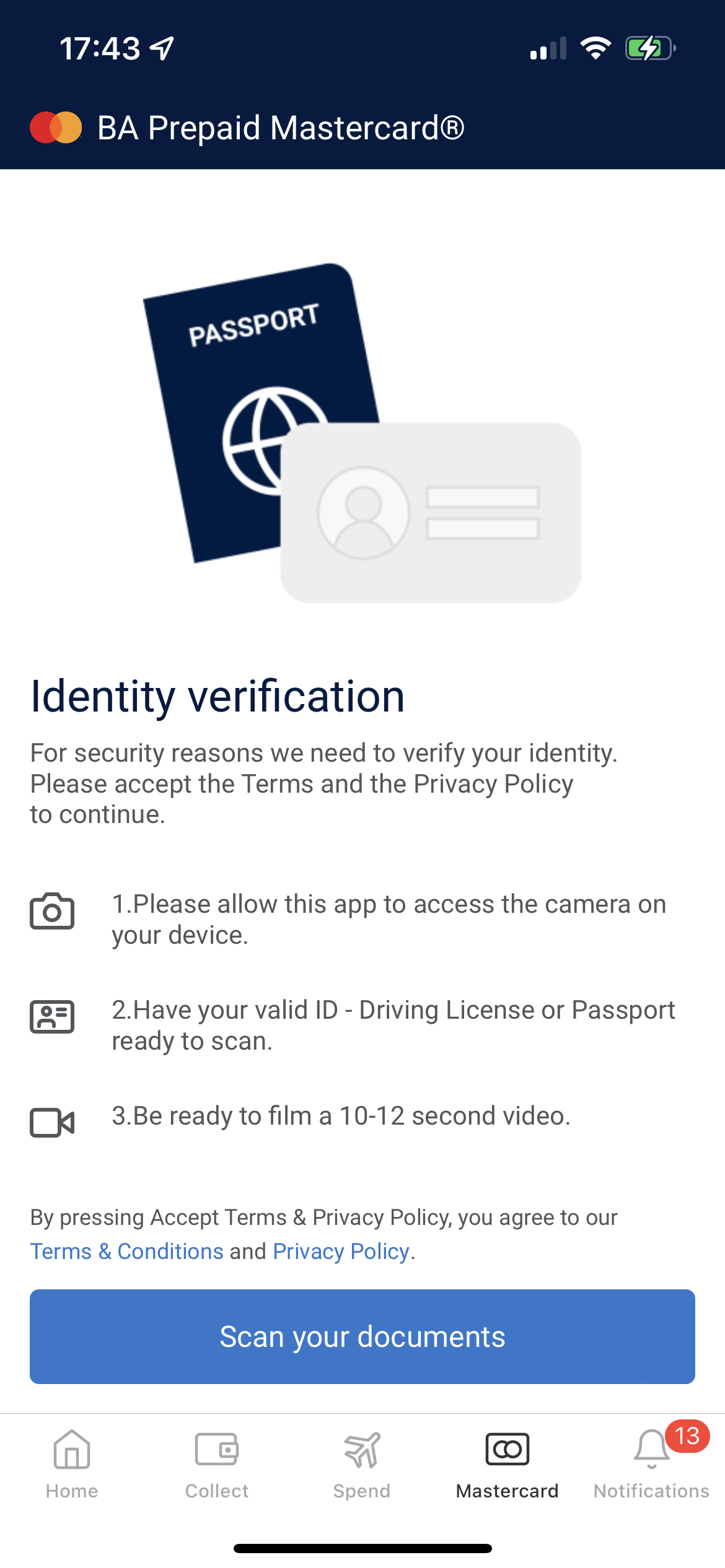

From here you fill in a simple application form with your details and source of funds, after this, you verify your ID with a facial scan and photograph of your ID. If you pass the automated checks your application will be approved within minutes otherwise if it requires a manual review it will take a few business days.

The finer details…

FX fees

Your card has 3 different e-wallet currencies GBP, EUR & USD. If you have a balance in any of these e-wallet currencies you won’t be charged any FX fees when making transactions in these currencies. If you don’t have a balance in these currencies or make a transaction in another currency you will be charged a 1.5% fee. Whilst you can only top up with GBP you can select to transfer from GBP through your currency e-wallet into either USD or EUR at the Applicable Exchange Rate. You will be quoted the current exchange rate when you go to swap.

ATM Usage Abroad

You can have 3 x FREE Monthly Withdrawals up to £300, 2% thereafter. Make sure you have a balance in the currency you wish to withdraw otherwise you will be charged an additional 1.5% fee.

Avios earning

You will earn 1 Avios per £2 on eligible purchases (Avios are calculated on the amount of the Transaction and then rounded to the nearest full Avios e.g. an £11.99 purchase would earn 6 Avios rather than 5.) As you might expect there are restrictions on what ‘purchases’ you can earn Avios on…

You cannot collect Avios:

- on your monthly card fee;

- on any means of digital electronic payment method (including but not limited to Bitcoin or casino money);

- on payments of rent for residential or business premises;

- on Payments for Court Costs, including Alimony and Child Support;

- on Payment of Fine;

- on Bail and Bond Payments;

- on Tax Payments to the HMRC

Domestic usage

You can use the card in the UK with no issues but avoid checking your balance using an ATM as it attracts a 50p fee, stick to using the app! You get 3 x FREE Monthly Withdrawals up to £300, a 2% fee will be charged thereafter.

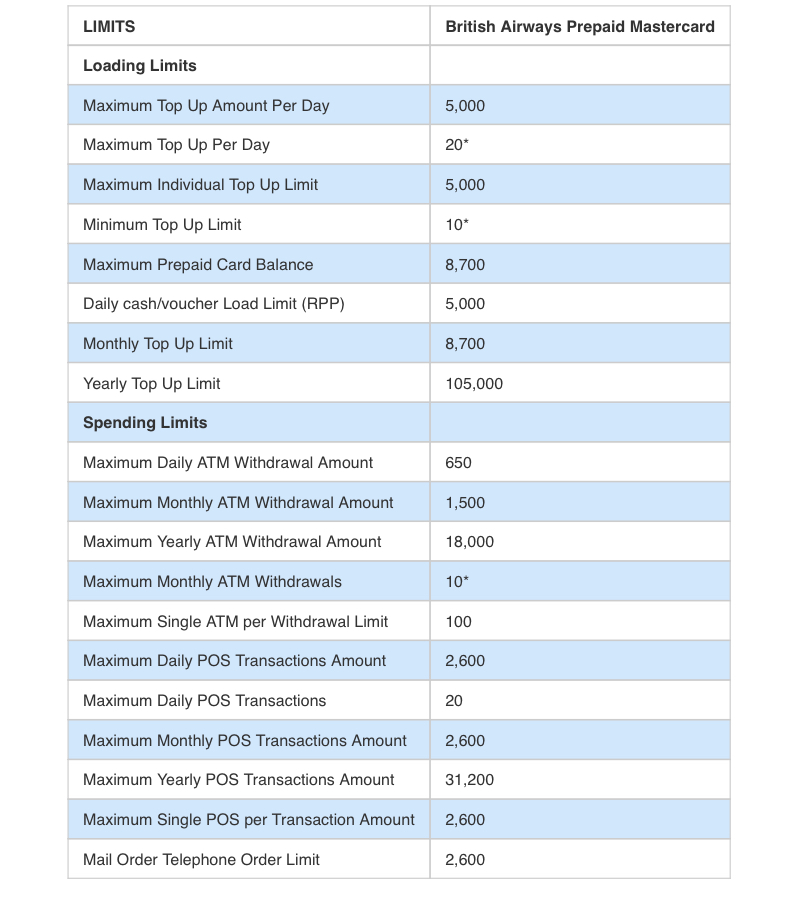

Top up/Spend limits

The card has various top-up/spend limits that you may find limit the card’s usefulness for you…

Conclusion

Whilst the earn rate isn’t particularly high at 1 Avios per £2 (the free BA Amex & BA Barclaycard earn 1 Avios per £1.) You could still find the card a useful addition to your wallet if you aren’t a fan of credit cards or haven’t already got a card with no foreign exchange fees.